[ad_1]

Advanced Micro Devices (NASDAQ: AMD) It posted another strong rise in daily trading on Friday. The company’s stock closed up 5.3%, according to data from S&P Global Market Intelligence.

There was no business-specific news for AMD, but the stock soared in conjunction with the latest bullish indicators on AI demand and growth opportunities. Dell released its fourth quarter report after the market closed on Thursday, and the results spurred further bullish momentum for artificial intelligence (AI) stocks.

Dell’s Q4 results provide latest bullish catalyst for AI stocks

If Wall Street was looking for another reason to be bullish on AI stocks, Dell’s fourth quarter report and guidance appears to have delivered just that. The company posted non-GAAP adjusted earnings of $2.20 per share on sales of $22.3 billion, beating the average analyst estimate of $1.72 per share on sales of approximately $22.15 billion. . Even better, the company indicated that it expects strong demand for its AI server products and expects this catalyst to drive strong performance through 2025.

Dell stock ended Friday trading up 31.6%, and the jump in stock price had a knock-on effect on the valuation of the top AI company. AMD stock is currently up 37.5% in 2024 trading and 158% over last year.

What will happen to AMD stock in the future?

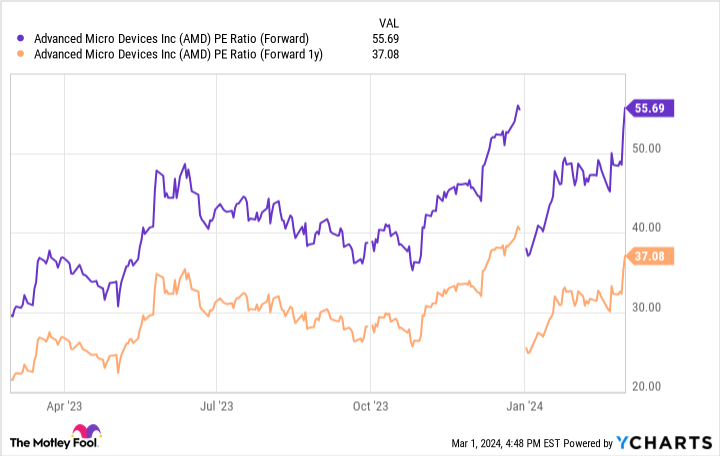

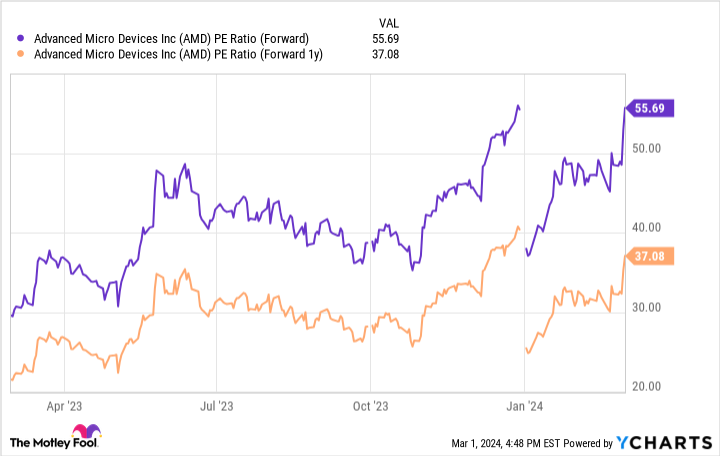

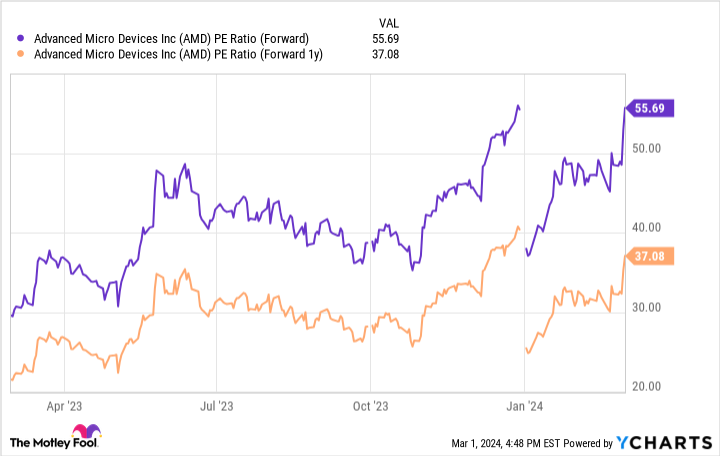

AMD’s stock price has risen incredibly thanks to excitement about the company’s opportunity in AI. The stock currently trades at 55.7 times this year’s expected earnings and 37 times next year’s expected earnings.

AMD’s interim guidance calls for revenue of approximately $5.4 billion in the first quarter of this year. Sales for this fiscal year are likely to be almost flat compared to the same period last year. Unlike Nvidia, AMD has yet to see explosive growth in sales and profits from sales of artificial intelligence (AI) processors, but the market is optimistic that growth will accelerate in the near future.

Where to invest $1,000 right now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Advanced Micro Devices made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Keith Noonan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Advanced Micro Devices. The Motley Fool has a disclosure policy.

Why AMD Stock Soared Again Today was published by The Motley Fool

[ad_2]

Source link