[ad_1]

defense contractor Northrop Grumman‘s (New York Stock Exchange: NOC) The most important programs are well over budget, and investors are raising the white flag. Northrop Grumman stock was down 7% as of 11 a.m. ET Thursday after the company reported a fourth-quarter loss and gave a bleak outlook for its new bomber.

Profit bomb due to high cost of B-21

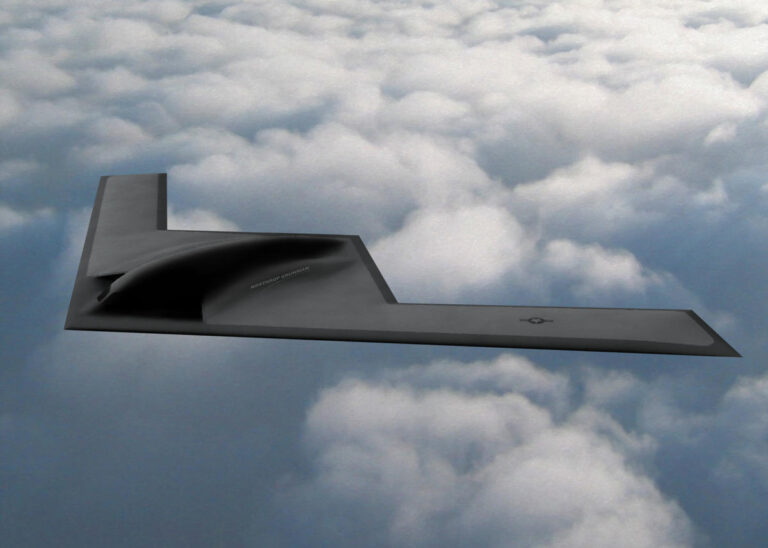

Northrop Grumman was one of the nation’s largest defense contractors at the time and the prime contractor for two-thirds of the U.S. nuclear triad renewal program, considered a top government priority. Northrop is tasked with developing new bombers and new missiles designed to serve as a deterrent against a potential nuclear attack.

However, the company’s recent performance still leaves a lot of room for improvement. Northrop posted a loss of $1.45 per share in the fourth quarter, well below Wall Street’s expectations for a profit of $5.80 per share. The main culprit was a $1.56 billion bill for the B-21 Raider bomber being built for the U.S. Air Force, reflecting rising costs since the 2015 contract. are doing.

Northrop warned that it was likely to incur losses on the first five lots of aircraft delivered under a fixed-price contract that capped the price per aircraft at about $700 million. Even without fees, results were moderate, and the company benefited from lower interest rates and corporate fees that offset weakness in its Space and Mission Systems segment.

The company forecast earnings per share of $24.45 to $24.85 in 2024, with an operating margin of approximately 11%. This is roughly in line with analyst expectations.Northrop’s sales-to-bills ratio (a measure of business booked in the future compared to the amount billed in the current quarter) was solid at 1.02, but not as high as its rivals. lockheed martinIts sales ratio for the quarter was 1.24.

Is Northrop Grumman a buy after its hefty fourth-quarter charge?

It’s worth noting that Northrop had been discussing possible charges related to the bomber program for about two years, so the charges were not a complete surprise. But some investors had hoped that the Pentagon would reinstate the contract or absorb some of the cost overruns, but that is unlikely to happen.

Defense investors need to focus on the long term, as these large-scale plans tend to take years to materialize. Notably, even though Northrop expects B-21 to weigh on cash generation through 2026, the company still expects free cash flow to grow more than 15% annually over the next few years. It means that it is predicted. The buyback will be used to fund the dividend, which currently has a yield of approximately 1.7%.

Northrop Grumman stock has roughly tracked the market’s performance over the past five years, and 2024 is likely to do the same.

There’s no reason for current Northrop investors to panic, but there are also better opportunities in the defense sector right now. Investors can afford to be patient if they are considering putting new money into Northrop Grumman.

Should you invest $1,000 in Northrop Grumman right now?

Before buying Northrop Grumman stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Northrop Grumman was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Lou Whiteman holds a position at Lockheed Martin. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

The article Why Northrop Grumman Stock is Killed Today was originally published by The Motley Fool.

[ad_2]

Source link