[ad_1]

snowflake (New York Stock Exchange: Snow) The stock rose significantly in trading on Friday. The company’s stock closed the day up 9.4%, according to data from S&P Global Market Intelligence.

There was no company-specific news to lift Snowflake today, but the company’s valuation benefited from strong financial results released by major cloud service providers. In particular, Amazon’s better-than-expected fourth-quarter results pushed Snowflake’s stock price up significantly.

Strong cloud demand bodes well for Snowflake

Snowflake is a leading provider of data warehousing services and related analytics and data management technologies. The company’s data cloud platform helps large companies and organizations combine information generated across multiple organizations. Amazon, microsoftand alphabetcloud infrastructure services. Similarly, strong demand metrics from major cloud infrastructure providers tend to bode well for Snowflake’s performance.

Amazon released its fourth quarter report after the market closed yesterday. The results showed that the company’s sales rose 14% year over year to $170 billion, significantly exceeding analysts’ average sales estimate of $166.2 billion. Revenue from the company’s Amazon Web Services (AWS) division rose 13% year over year to $24.2 billion.

Amazon’s strong fourth-quarter report comes on the heels of Microsoft’s better-than-expected results earlier this week. In the second quarter of its current fiscal year, which ends at the end of December 2023, Microsoft posted revenue of $62.02 billion, beating Wall Street’s revenue estimate of $61.12 billion for the same period. The software giant’s revenue rose 18% year over year in the period, with revenue from its Azure infrastructure business and other cloud services up 30% year over year.

Is Snowflake stock a buy?

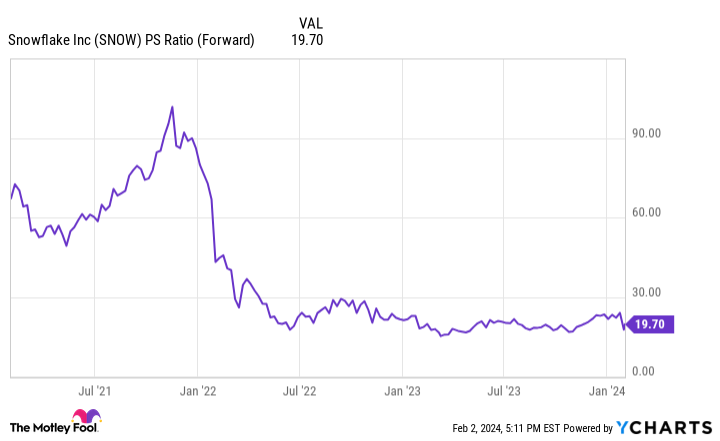

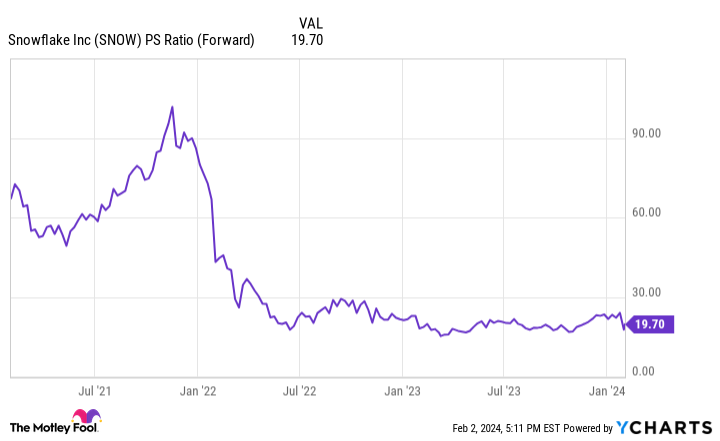

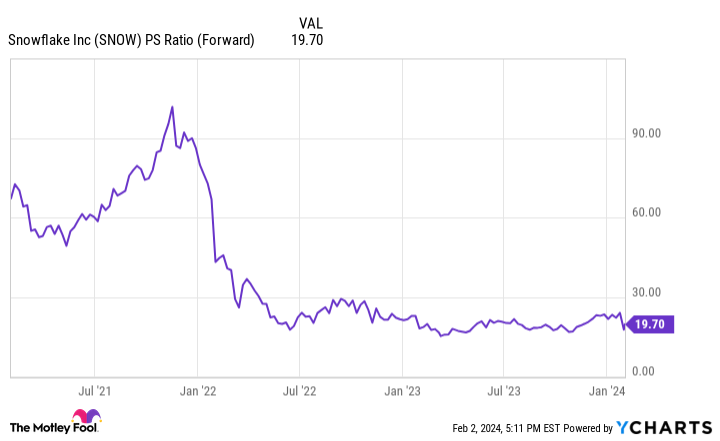

Snowflake stock is seeing strong momentum amid excitement around artificial intelligence (AI) and an improving demand outlook for its major cloud businesses. Meanwhile, the company’s stock is still down about 46% from the peak it reached in 2021.

Snowflake’s valuation, valued at about 20 times this year’s expected sales, is highly dependent on growth. The company’s valuation profile means its stock may not be the best fit for all investors.

Meanwhile, Snowflake is growing rapidly and is poised to continue playing a key role in the evolution of analytics and AI services. For risk-tolerant investors, this stock is a worthwhile addition to your portfolio, but you should consider your personal tolerance for volatility before investing heavily in stocks.

Should you invest $1,000 in Snowflake right now?

Before purchasing Snowflake stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Snowflake wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 29, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Snowflake. The Motley Fool has a disclosure policy.

Why Snowflake Stock Soared Today was first published by The Motley Fool

[ad_2]

Source link