[ad_1]

That was a problem, officials say in court papers, because Tango was owned by a Russian billionaire under U.S. sanctions, and doing business on his behalf violated federal law.

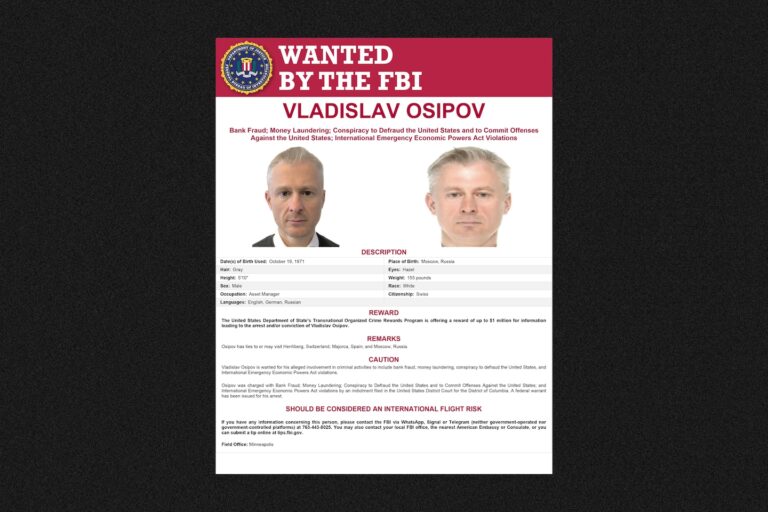

Late last month, U.S. authorities unveiled a $1 million reward for information leading to the arrest and or conviction of the man they say was running the yacht staff and orchestrated the deception with the robes — Vladislav Osipov, 52, a Swiss-based businessman from Russia. In a new indictment, federal prosecutors say Osipov misled U.S. banks and companies into doing business with the Tango yacht despite the sanctions on the Russian owner, whom the Justice Department has identified as billionaire Viktor Vekselberg.

Osipov has denied the allegations. Osipov’s attorney has said that the government has failed to demonstrate that Vekselberg owned the yacht, and that its management was therefore not a sanctions violation.

The reward offer for Osipov reflects the latest stage in the evolution of the West’s broader financial war against Russia two years into the war in Ukraine, as the United States and its allies increasingly target intermediaries accused of enabling Russian oligarchs to circumvent sanctions.

Many Russians close to President Vladimir Putin have been under sanctions dating to 2014, when Russia seized Crimea from Ukraine and sent proxy forces into that country’s eastern Donbas region. When Russia invaded Ukraine in 2022, President Biden vowed to deal a “crushing blow” with a barrage of new sanctions on financial institutions, industries, business executives and others tied to the Kremlin. But roughly two years later, Russia’s economy has proved surprisingly resilient after the nation poured tens of billions of dollars into ramping up its military industry. Moscow has also worked around the sanctions, finding new third parties to supply it with critical military and industrial hardware, as well as countries beyond Europe to buy its oil.

Now, the West is trying to increase the reach of its sanctions by digging deeper into Russian supply chains. Late last month, the Treasury Department announced more than 500 new sanctions targeting Russia, primarily on military and industrial suppliers. The Justice Department also announced charges against two U.S.-based “facilitators” of a Russian state banker who is under sanction, as well as the guilty plea of a dual national based in Atlanta who was accused of laundering $150 million through bank accounts and shell companies on behalf of Russian clients.

Prioritizing criminal charges against — and the arrests of — Western employees of Russia’s elites represents a new escalation of the U.S. financial war against Putin, experts say. One Moscow businessman, speaking on the condition of anonymity for fear of retribution, said many influential Russians are concerned about the arrest of two associates of Andrey Kostin, the head of VTB, Russia’s second-biggest state bank. These associates, Vadim Wolfson and Gannon Bond, were charged with helping Kostin evade sanctions by maintaining a $12 million property in Aspen, Colo., for Kostin’s benefit while concealing his ownership. Kostin has said that the charges of sanctions evasion against him are “unfounded” and that he has not violated any laws. Bond has pleaded not guilty; Wolfson hasn’t made an initial court appearance yet.

Wolfson, also known as Vadim Belyaev, had been a Russian billionaire until the Russian government took over his bank in 2017. Bond, 49, is a U.S. citizen from Edgewater, N.J. For all Russians living abroad and working with people in Russia, the threat of criminal charges is a much more worrying prospect than the sanctions imposed by the Treasury Department last month against hundreds of individuals and entities, the businessman said, in part because sanctions are far easier to dodge than criminal charges.

“What you have seen through today’s public announcements are our efforts at really targeting the facilitators who possess the requisite skill set, access, connections that allow the Russian war machine [and] the Russian elites to continually have access to Western services and Western goods,” David Lim, co-director of the Justice Department’s KleptoCapture task force, which is tasked with enforcing U.S. sanctions over Russia’s invasion of Ukraine, told reporters last month.

Thad McBride, an international trade partner at the law firm Bass Berry & Sims, said the crackdown on intermediaries reflected the natural evolution of the U.S. sanctions campaign in response to Russian adjustments.

“It seems to me they have gone through a comprehensive list of the oligarchs, and you can debate whether or not it’s had a meaningful impact on the Russian war effort,” McBride said. “Because they’re getting smarter about who’s who, they’re finding other people who play meaningful roles in these transactions, even though they’re not showing up in the headlines.”

The charges against Osipov related to his alleged management of the Tango yacht illustrate the mounting potential consequences for people in Europe and the United States who attempt to do business with Russians targeted by Western allies, as well as the opaque structures allegedly employed by those seeking to evade sanctions.

With a net worth estimated by Forbes in 2021 at $9 billion, Vekselberg, 66, has long drawn scrutiny from the West — and sought to safeguard his wealth. He made his initial fortune in aluminum and oil in Russia’s privatization of the 1990s and then expanded into industrial and financial assets in Europe, the United States and Africa, with Putin’s blessing. In addition to the yacht, federal prosecutors say, Vekselberg acquired $75 million worth of properties, including apartments on New York’s Park Avenue and an an estate in the Long Island town of Southampton.

Vekselberg, who declined to comment for this article, has not been criminally charged by the Justice Department. In a 2019 interview with the Financial Times, he denounced the sanctions as arbitrary and harmful for international business, saying he had been targeted just because he was Russian and rich and knows Putin.

In April 2018, the Treasury Department under the Trump administration sanctioned Vekselberg and six other Russian oligarchs as part of broader financial penalties over the Kremlin’s invasion of Crimea, support for President Bashar al-Assad in Syria and interference in the 2016 U.S. presidential election. Vekselberg was also targeted for his work for the Kremlin as chairman of the Skolkovo Foundation, an attempt to create Russia’s version of the Silicon Valley — evidence that appeared to undermine the Russian businessman’s claims that he operated independently of the Kremlin.

But with Vekselberg’s payments monitored by U.S. banks, according to the federal indictment, Osipov used shell companies and intermediaries to avert the bite of sanctions. Vekselberg kept other major assets out of the reach of U.S. authorities by making use of the Treasury Department’s 50 percent ownership rule, which stipulates that it is illegal to transact with firms only if an owner under sanction controls more than 50 percent of the business.

For example, a month after Treasury imposed sanctions on Vekselberg in April 2018, his Renova Innovation Technologies sold its 48.5 percent stake in Swiss engineering giant Sulzer to Tiwel Holding AG, a group that is nevertheless still “beneficially owned” — meaning, owned in practice — by Vekselberg through Columbus Trust, a Cayman Islands trust, according to Sulzer’s corporate filing. Vekselberg’s longtime right-hand man at Renova, Alexei Moskov, replaced one of Vekselberg’s direct representatives on the board. Moskov told The Washington Post that he stepped down from all his executive positions at Renova Group in 2018 after U.S. sanctions were first imposed and from that moment ceased to be Vekselberg’s employee.

The attempts to circumvent the sanctions appear to have found some success in the U.S. legal system. Columbus Nova, a U.S.-based asset management fund controlling more than $100 million in assets in the U.S. financial and tech industry, is run by Vekselberg’s cousin, Andrew Intrater. The firm battled for more than two years to lift a freeze on Columbus Nova’s assets, imposed by Treasury’s Office of Foreign Assets Control because of the sanctions on Vekselberg, and won, reaching a settlement agreement with the Treasury Department. After renaming itself Sparrow Capital LLC, Columbus Nova successfully argued that Intrater — not Vekselberg — owns the fund. Intrater argued that the company was 100 percent owned by U.S. citizens and that no individual or entity under sanction held any interest in it. Intrater said Columbus Nova had earned fees for managing investment funds owned by Renova. He said he had repeatedly told Treasury he would not distribute any funds to Vekselberg.

Now Osipov, the alleged manager of Vekselberg’s $90 million yacht, is attempting a similar argument as U.S. authorities seek his arrest on charges of bank fraud, money laundering, conspiracy to defraud the United States, and violations of sanctions law.

The federal indictment states that the Tango was owned by a shell corporation registered in the British Virgin Islands that was in turn owned by several other companies. The Virgin Islands shell company, authorities say, was controlled by Osipov, who also served in senior roles for multiple companies controlled by Vekselberg. U.S. officials also say Vekselberg ultimately controlled the other companies that owned the Virgin Islands shell company.

According to the indictment, a Tango official instructed a boat management company in Palma de Mallorca, Spain, to use a false name for the yacht — “Fanta” — to disguise its true identity from U.S. financial institutions and firms, which try to avoid doing business with an entity or person under sanction.

Working at Osipov’s direction, according to the indictment, employees for Tango bought more than $8,000 worth of goods for the yacht that were unwittingly but illegally processed by U.S. firms and U.S. financial institutions, including navigation software, leather basket magazine holders provided by a bespoke silversmith, and web and computing services. The management company running Tango, run by Osipov, also paid invoices worth more than $180,000 to a U.S. internet service provider, federal prosecutors say.

The Tango was seized by the FBI and Spanish authorities in the Mediterranean not long after Russia invaded Ukraine in 2022, and Osipov was first indicted last year. The owner of the Spanish yacht management company hired by Osipov, Richard Masters, 52, of Britain, was criminally charged last year by federal prosecutors with conspiracy to defraud the United States and violating federal sanctions law. A request for comment sent to Masters’ firm was not returned.

But in recent court documents, Osipov’s attorney argues that the yacht was not more than 50 percent owned by Vekselberg, and that the government hasn’t demonstrated it was. Barry J. Pollack, an attorney at Harris, St. Laurent and Wechsler, also says the government never warned Osipov of its novel and “unconstitutional” application of federal sanctions law.

“The government points to no precedent that supports its extraordinary interpretation and cites no authority that allows the traditional rules of statutory construction to be turned on their head,” Pollack wrote in a defense filing. The filing adds: “[Osipov] is not a fugitive because he did not engage in any of the allegedly criminal conduct while in the United States, has never resided in the United States, did not flee from the United States, and has not concealed himself.”

Still, the State Department’s Transnational Organized Crime Rewards Program has said it will provide up to $1 million for information leading to Osipov’s arrest, warning that he may visit Herrliberg, Switzerland; Majorca, Spain; or Moscow.

The case demonstrates the extent of the U.S. commitment to tighten the screws on those seen as aiding Russian elites, even if they themselves are not closely tied to the Kremlin.

“When DOJ levels legal action against an individual or entity, they have quite a bit of evidence, especially because the threshold to press charges for money-laundering and sanctions evasion is so high,” said Kim Donovan, director of the Economic Statecraft Initiative within the Atlantic Council’s GeoEconomics Center. “We’ve had quite a bit of experience targeting Russia directly, and what you’re starting to see is the U.S. go after the facilitators enabling sanctions evasion. That’s where the U.S. is focusing its efforts right now.”

[ad_2]

Source link