[ad_1]

Hong Kong-listed shares of China-based Alibaba Group Holding Limited (Hong Kong:9988) fell by almost 15% in 2023. The stock has lost about 60% of its value over the past five years. Nevertheless, analysts are bullish on Alibaba stock and predict the stock price will rise steadily. Additionally, this stock has a perfect score of 10 in the TipRanks Smart Scores tool, indicating its potential to outperform the market.

Alibaba is a Chinese technology company that is widely known for its online marketplace.

bullish case

Despite being a major player in the e-commerce industry, BABA stock has failed to create wealth for investors since its Hong Kong listing. The company has faced various regulatory and competitive pressures, resulting in a decline in its stock price. Furthermore, the downturn in the Chinese economy also affected investor sentiment.

Meanwhile, analysts remain hopeful about the tech giant, maintaining their Buy rating. Analysts are bullish on the stock mainly due to the company’s dominance in cloud and e-commerce businesses. The company has also streamlined its operations, splitting its business into six business units last year. The move was aimed at resolving some of the company’s regulatory issues and allowing it to pursue separate IPOs for its six divisions in the future.

Last week, Jefferies analyst Thomas Chong reiterated his Buy rating on Alibaba stock, predicting a massive 85% rise in the stock price.

Earlier, JPMorgan analyst Alex Yao also confirmed a Buy rating on the stock, predicting 59% growth.

Is Alibaba a good stock to buy now?

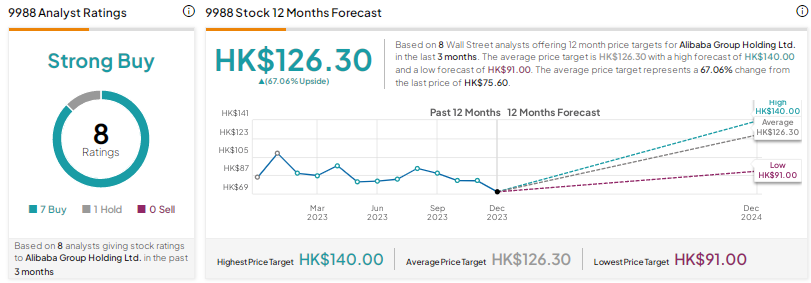

At TipRanks, the 9988 stock receives a “Strong Buy” consensus rating based on 7 buy recommendations and 1 hold recommendation. Alibaba’s price target is HK$126.30, reflecting 67% upside potential at the current trading price.

disclosure

[ad_2]

Source link