[ad_1]

Older enterprise software providers oracle (NYSE:ORCL) It’s no longer a growth stock. Since the dot-com bust, the company has been pretty mediocre.

However, Oracle’s revenue growth is a different story. This means that even decades after their founding, top software companies rely on “infinitely scalable” business models, meaning they can build a software product once and sell it over and over again, generating incredibly high profits. This is further evidence that we can show off the benefits of our business model. margin.

Recently, Oracle has been layering cloud infrastructure (OCI) into its product suite, making a name for itself by signing a first-of-its-kind deal in the fall of 2022. Nvidia For AI training hardware. A follow-up agreement was signed in spring 2023 for his OCI first access to Nvidia’s DGX Cloud AI training services.

Oracle may not be among the top cloud computing stocks for many investors, but it’s time to change that perception.

Oracle Cloud is growing rapidly

In the latest earnings call, Oracle CEO Safra Catz explained that the company continues to win many new customers as it makes big bets on AI infrastructure. Growth was slightly constrained by hardware supply constraints. Nevertheless, his OCI Infrastructure-as-a-Service (IaaS), in which customers “rent” AI training hardware housed in remote data centers, grew 49% year-over-year in the last quarter to 18%. It has grown to a billion dollars.

When combined with its legacy software-as-a-service (SaaS) business, including sales from the Cerner healthcare software business acquired in summer 2022, OCI’s total revenue increased 25% year over year to $5.1 billion. Ta.

On an annual basis, OCI’s sales exceeded $20 billion. Still, Oracle lags far behind its larger cloud peers, including: Amazon AWS ($97 billion in annual revenue as of Q4 2023); microsoft (annual revenue of $104 billion, consisting of the Azure cloud and its traditional cloud-based software), and alphabetGoogle Cloud ($37 billion annually). But it’s clear that his OCI infrastructure division, in particular, has grown well above the industry average and is enjoying great success thanks to its partnership with Nvidia.

For reference, technical researchers gartner The company said it expects IaaS user spending to grow at a 20% growth rate in 2023 and further increase by 26% in 2024.

Relative cloud value or fully matched stocks?

Of course, Oracle is an old business, and Catz and company’s advances in OCI merely compensate for the weaknesses of traditional software. As a result, total revenue increased only 7% year over year last quarter.

But, and this is important, what Oracle lacks in high growth rates, it more than makes up for in impressive revenue performance. Earnings per share increased 16% in the prior quarter compared to the same period last year as Oracle squeezed higher margins from new businesses, squeezed synergies from a major acquisition of Cerner, and returned excess cash to shareholders through its stock repurchase program. ($1.1 billion deployed in the first nine months) and an additional $3.3 billion to be paid out in dividends in fiscal year 2024).

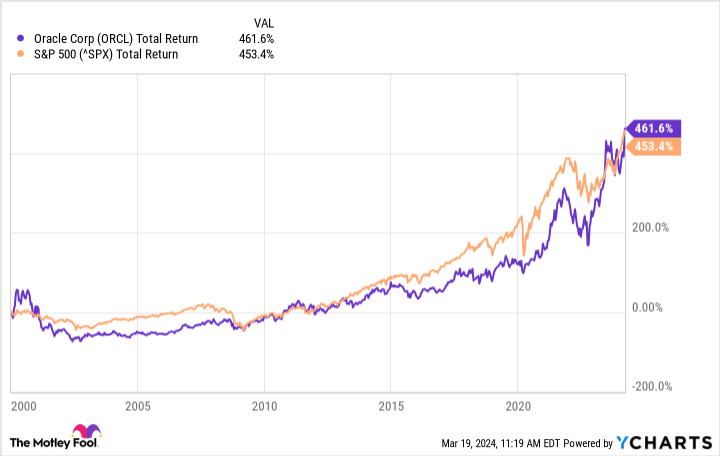

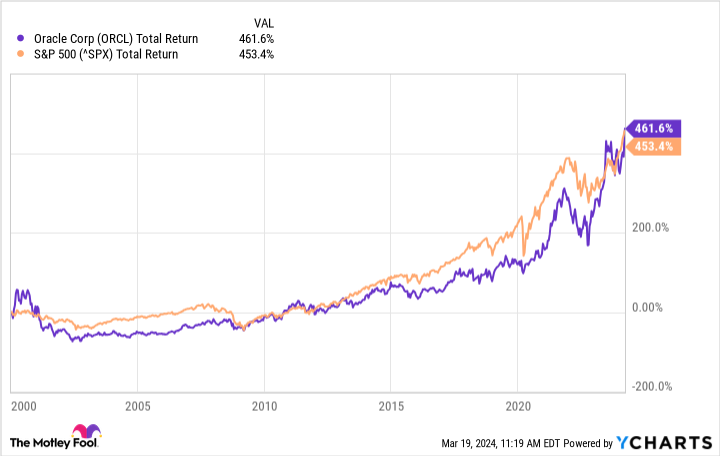

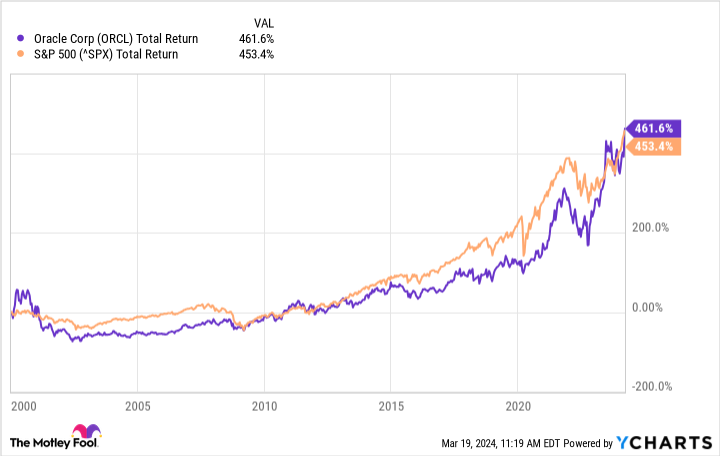

We talk about so-called infinite scalability. This mature technology company can still deliver impressive returns to shareholders even after its prime. Even using a less favorable timeline going back to January 1, 2000 (just before the dot-com bubble burst and Oracle and his friends were wrecked), this stock is actually a solid long-term buy. It was an and hold.

As of this writing, Oracle stock trades at 34 times trailing 12-month earnings per share, or just under 30 times free cash flow. Investors should at least keep an eye on this, as the company continues to win business and achieve even faster profit growth in the new era of AI.

Should you invest $1,000 in Oracle right now?

Before purchasing Oracle stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Oracle wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Nicolas Rossolillo and his clients have held positions at Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool endorses his Gartner and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

Will Oracle be a top cloud stock in 2024?Originally published by The Motley Fool

[ad_2]

Source link