[ad_1]

walmart (NYSE:WMT) Head to Splitsville. No, the giant discount retailer isn’t going to be spun off into a separate company. There are no plans to sell the unit.

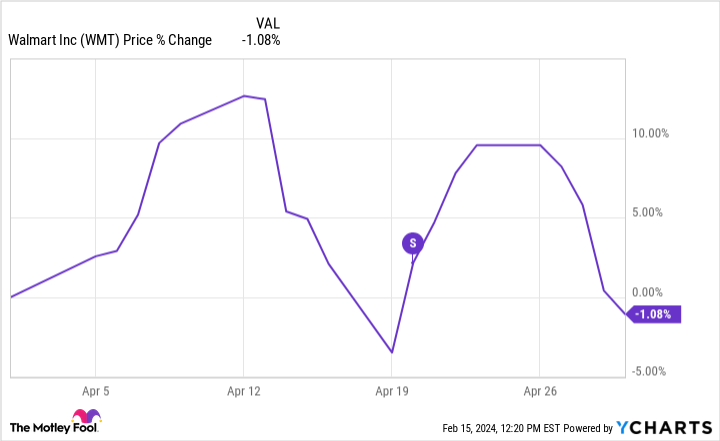

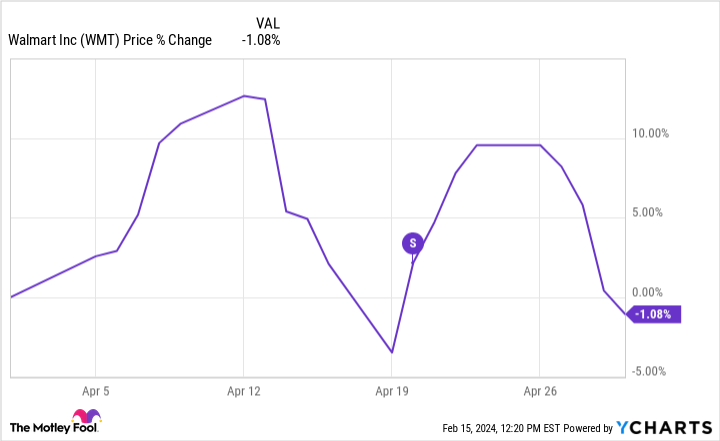

Instead, I’m referring to Walmart’s announcement about two weeks ago that it plans to implement a 3-for-1 stock split on February 26, 2024. CEO Doug McMillon blamed the company’s split on founder Sam Walton. He felt that Walmart’s stock price should be affordable to its employees. “Given our growth and future plans, we felt it was a good time to split our stock and encourage our employees to participate in the coming years,” McMillion said.

Will Walmart’s stock price skyrocket after the upcoming stock split? Here’s what history shows:

Walmart stock split history

Before touching on its history, let’s first consider why stock splits are triggered. The idea is that many individual investors are less likely to buy stocks with high stock prices. Because a stock split lowers the stock price, these investors may rush to buy the stock at a lower price. This creates buying pressure and increases the stock price.

Does this theory work in the real world? Sometimes it does. Sometimes that doesn’t happen.

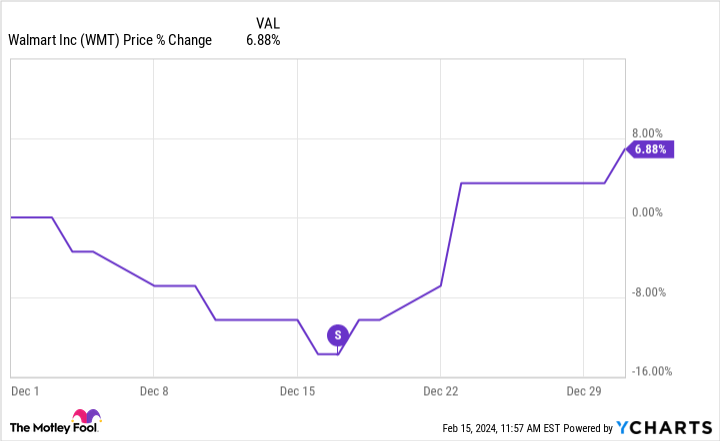

Walmart has conducted nine 2-for-1 stock splits. The first day he was there was August 25, 1975. There was no significant movement in the stock price before or after the split. However, his next 2-for-1 stock split of the company on December 17, 1980 was a different story. Walmart’s stock price was declining before the split, but it rebounded nicely after the split.

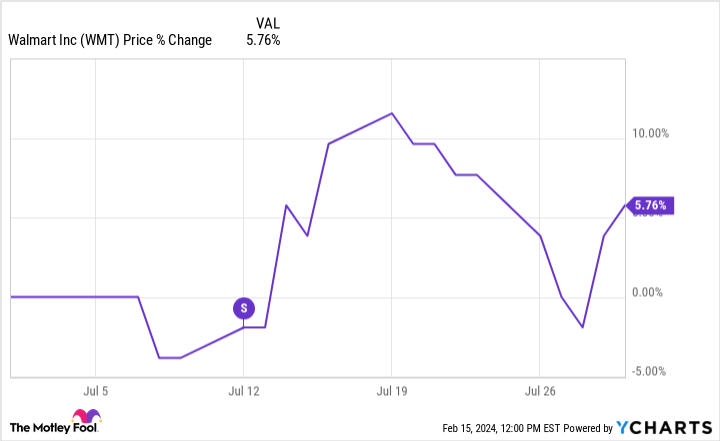

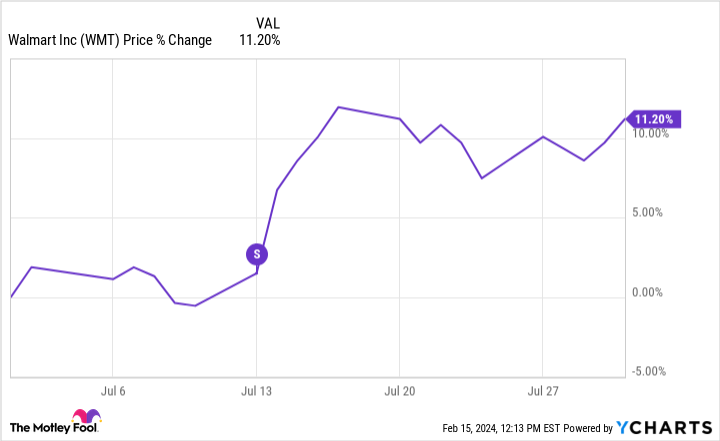

On July 12, 1982, Wal-Mart conducted another stock split. Again, the splitting appears to have acted as a catalyst.

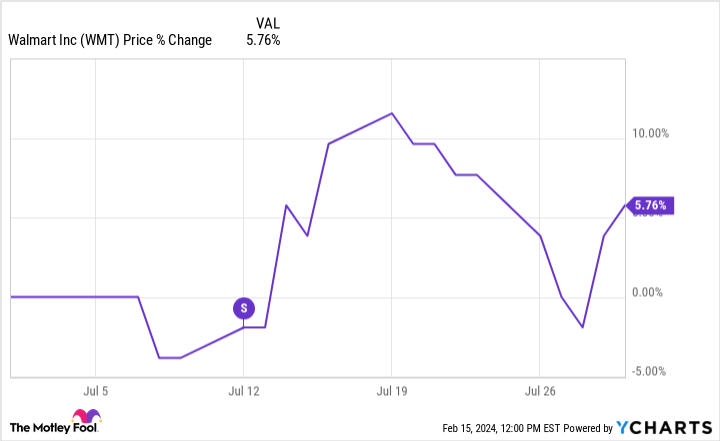

Almost exactly a year later, the discount retailer is back in action. Wal-Mart conducted another 2-for-1 stock split on July 11, 1983. In this case, the stock price rose immediately after the split, then fell within a few days.

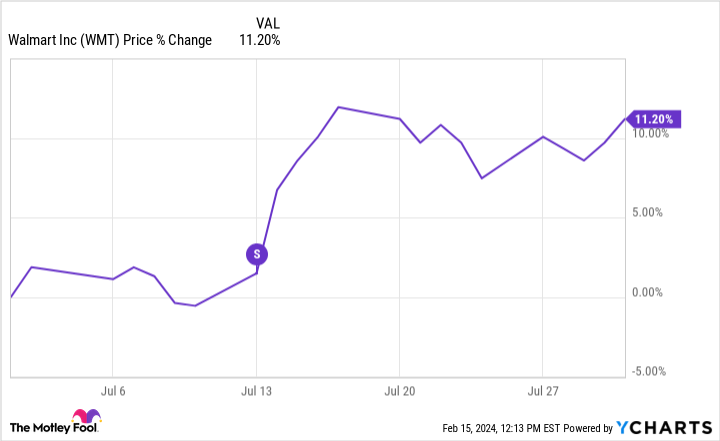

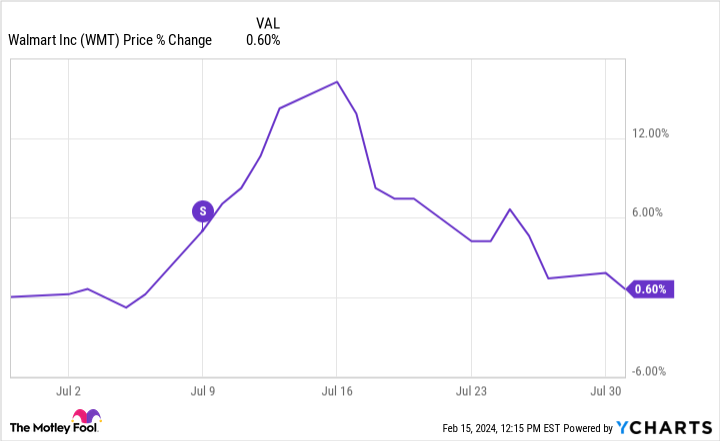

Wal-Mart’s next two breakups occurred in October 1985 and July 1987. Wal-Mart’s stock price skyrocketed after each split, with the July 13, 1987 split being the most significant.

However, this pattern is not always reproduced. For example, it is not clear whether the July 9, 1990 stock split caused Wal-Mart’s stock to rise, since the uptrend had already begun.

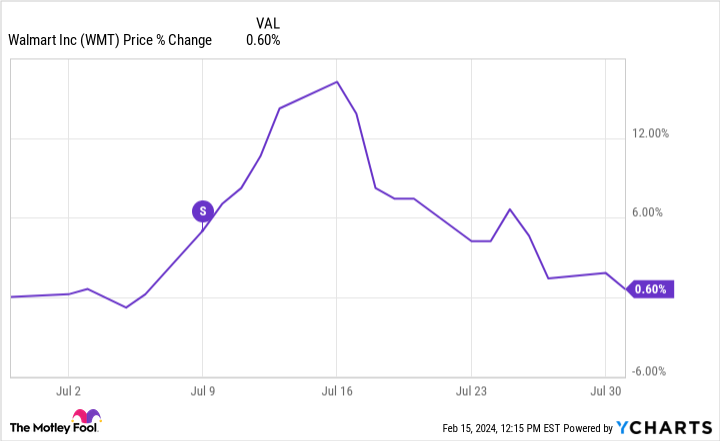

It is also unclear whether Wal-Mart’s next stock split on February 26, 1993 had an impact on stock price performance. The stock price was already rising before the split, and continued to rise for several days after the split.

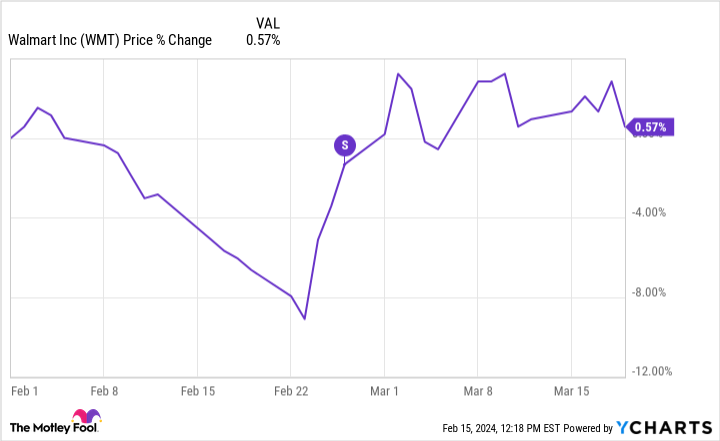

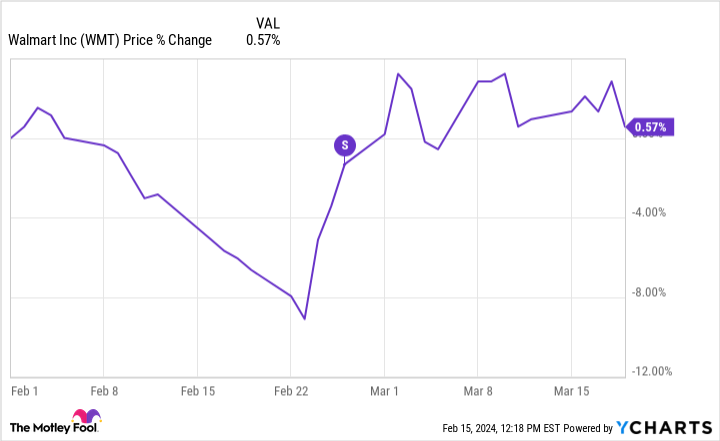

Walmart’s most recent stock split took place on April 20, 1999. Whether this split was the trigger is also debatable. The stock price had already rebounded before the split. Walmart’s stock price continued to rise temporarily even after the split. But all the profits quickly evaporated.

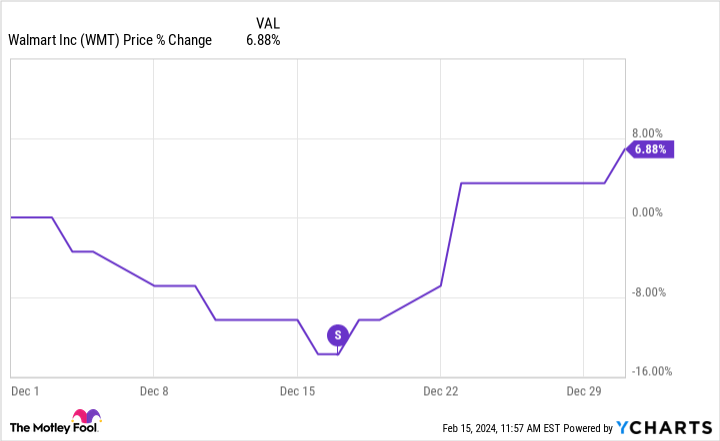

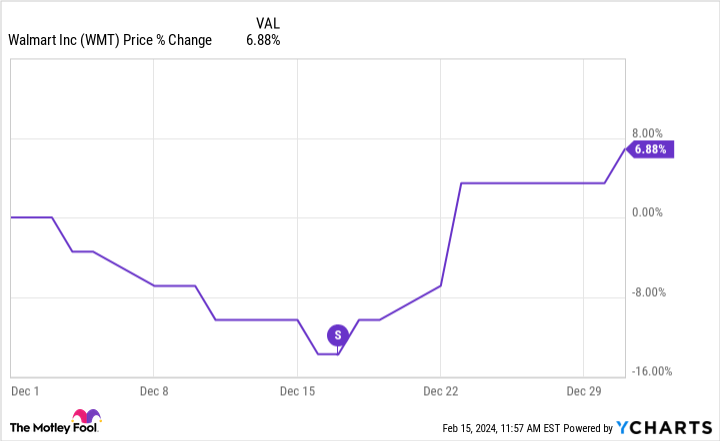

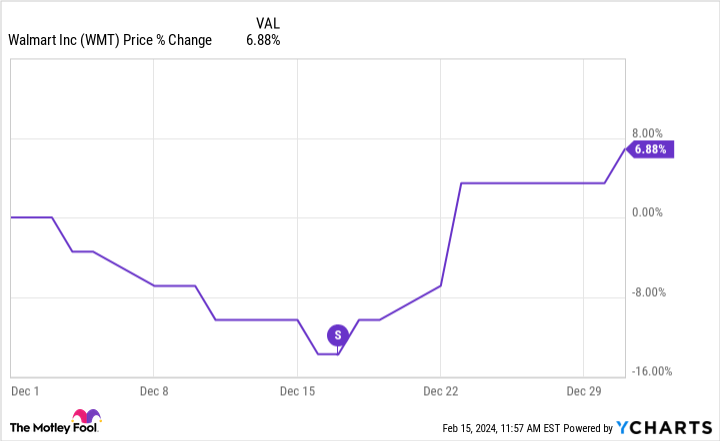

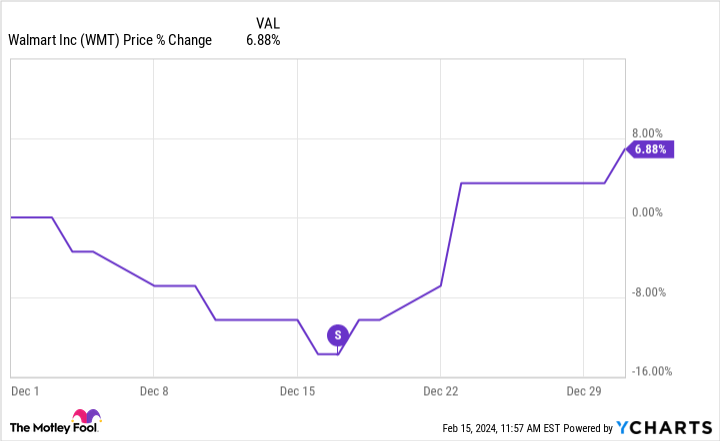

WMT data by YCharts

Important lessons learned from the history of Walmart’s stock splits

I think there is one important lesson from the history of Walmart’s stock splits. That means there’s no way to know what will happen to the stock after the split. Investors should focus on the company’s underlying business, growth prospects, and valuation.

Walmart’s underlying business is doing very well. Wall Street expects the company to generate about $645 billion in revenue in fiscal 2024. Walmart continues to generate solid profits and free cash flow.

To be sure, Walmart doesn’t have tremendous growth prospects now that it’s a retail giant with a market capitalization of more than $450 billion compared to just a few years ago. However, the company’s e-commerce and advertising businesses stand out as his two key growth drivers for the future.

My biggest concern with Walmart is its valuation. The company’s stock is trading at a forward price/earnings ratio (PER) of 23.8 times. Insurance premiums are not prohibitively high, but they are not cheap either. I still like Walmart as a long term option. However, waiting for a pullback before buying may be the wisest move for investors.

Should I invest $1,000 in Walmart right now?

Before buying Walmart stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Walmart wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Keith Speights has no position in any stocks mentioned. The Motley Fool has a position in and recommends Walmart. The Motley Fool has a disclosure policy.

Will Walmart’s stock price skyrocket due to an upcoming stock split? Here’s what history shows:Originally published by The Motley Fool

[ad_2]

Source link