[ad_1]

Government IT Security Contractor Stock Palantir Technologies (NYSE:PLTR) reported a 20% increase in quarterly sales and a more than 200% increase in quarterly profit, and had a great month in February, jumping more than 50%. However, as a result of this rapid rise in price, the company’s stock now trades at a nosebleeding 270 times its price-to-earnings ratio, and an even 77 times next year’s expected earnings.

But is that too much to pay for Palantir? According to William Blair analyst Louis DiPalma, while there are upsides to the stock, it’s actually too much to pay. That’s why DiPalma actually thinks he should sell his Palantir stock, despite its obvious popularity.

Why does he think that?

First of all, the good news. Concluding his Bloomberg report on Thursday night, DiPalma noted that Palantir is deeply involved in a U.S. Department of Defense “machine vision” project called “Maven.” The project aims to employ artificial intelligence algorithms to help military drones find targets. Moreover, this so-called Maven Smart System has advanced beyond theory and is now said to be actually deployed in the Red Sea conflict zone.

Although Palantir is not the only IT company involved in Maven and its defense business is not growing as quickly as its competitors, DiPalma believes that revenue from Maven will drive Palantir’s revenue in the first quarter of 2024. I believe it will be helpful. DiPalma’s objections are as follows. This increase is probably not large enough to justify Palantir’s valuation after its recent surge.

In fact, DiPalma even seems to go so far as to argue that Palantir stock was overvalued before the stock price began to tumble in February. In providing guidance for 2024 revenue, Palantir told investors to expect numbers in the range of $2.65 billion to $2.67 billion. This would mean an increase in revenue of around 19% compared to 2023 levels, which sounds pretty good. The problem is, before this guidance was released, analysts believed Palantir stock was likely to generate more than $2.8 billion in revenue, valuing the stock at between $6 and $8 per share. It was set in the range.

Again, even though investors thought Palantir would generate more revenue than management just said, it still traded at a price 76% lower than where it currently trades. They were evaluating the company’s stock. Conversely, investors are now paying four times as much for a company that just announced lower-than-expected earnings.

Does that make sense? Because that’s not the case with DiPalma.

While it’s true that Palantir finally turned a profit in 2023 (and that’s a good thing), dividing the $25+ share price by the $0.09 per share it earned last year gives it a P/E ratio of 278x. Earnings are expected to increase 44%, or $0.13 per share, this year and 31%, or $0.17 per share, over the next year. So, this means that the forward P/E ratios are 192 and 147, respectively. Income for the next two years.

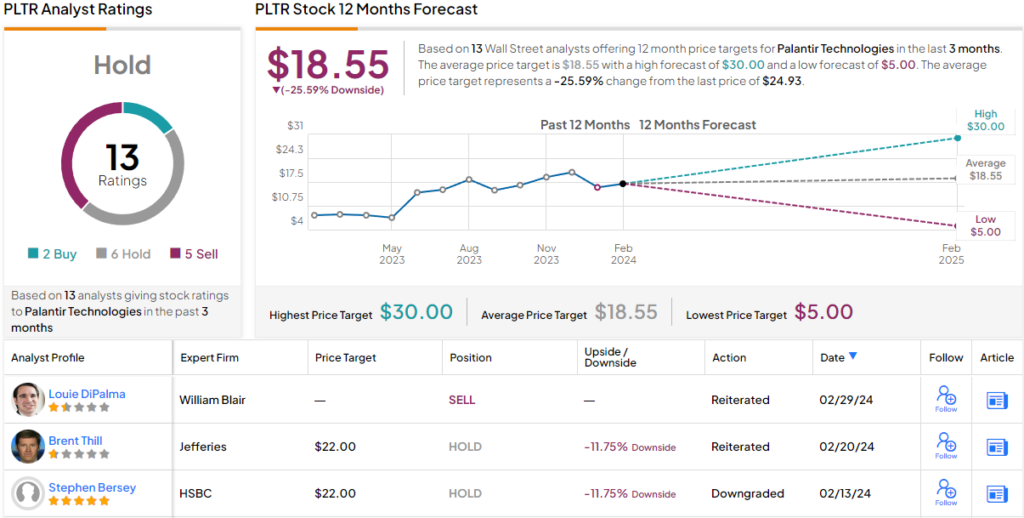

Overall, the Street is currently lukewarm on the outlook for Palantir stock. Based on his 13 analysts tracked by TipRanks in the past three months, 6 rate his PLTR as a Hold (i.e. Neutral), 5 recommend Sell, and only 2 recommended buying. The average 12-month price target is $18.55, representing approximately 26% downside from the stock’s current trading level. (look PLTR stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link