[ad_1]

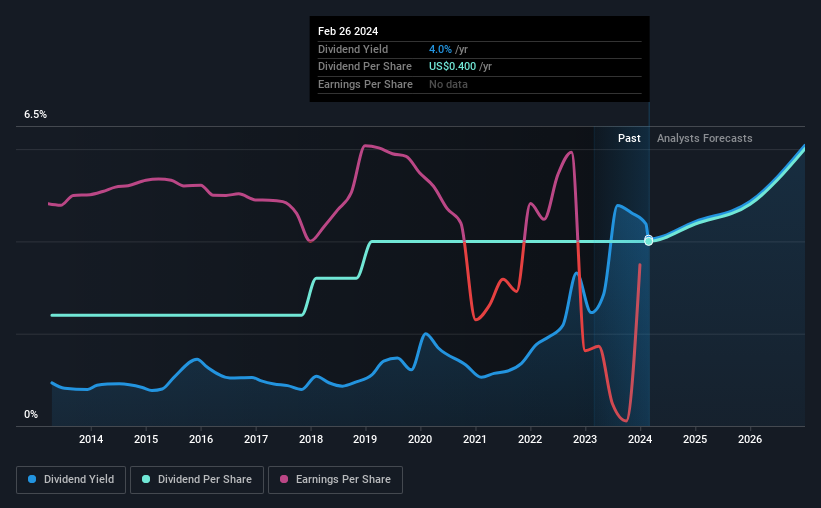

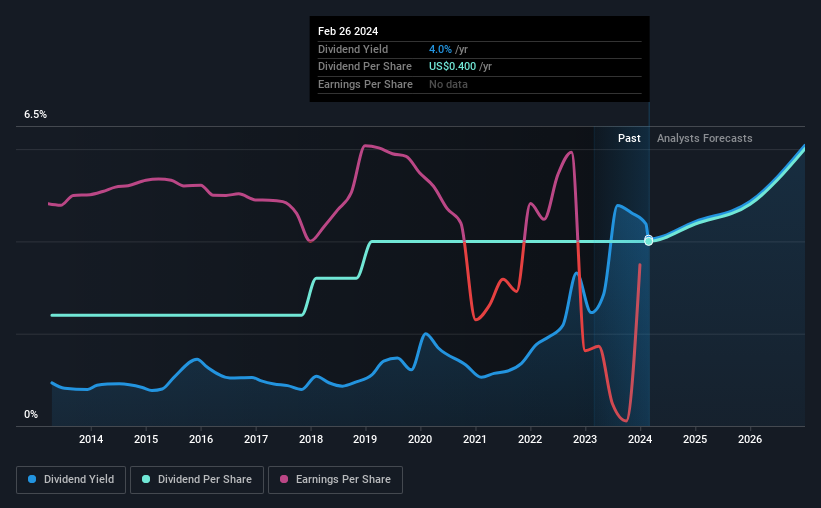

board of directors Wolverine Worldwide, Inc. (NYSE:WWW) has announced that it will pay a dividend on May 1, with investors receiving $0.10 per share. This results in a dividend yield of 4.0%, which significantly increases investors’ profits.

Check out our latest analysis for Wolverine Worldwide.

Wolverine Worldwide’s dividend is well covered by profits.

It’s great to have a high dividend yield, but you also need to consider whether the payments are sustainable. Although Wolverine Worldwide isn’t making a profit, its free cash flow easily covers the dividend, leaving plenty of money to reinvest in the business. We generally believe that cash flow is more important than accounting profit metrics, so we’re quite happy with this level of dividend.

According to analysts, next year’s EPS should increase several times. Assuming that dividends continue in line with recent trends, he believes the dividend payout ratio will be 31%, which he believes is satisfactory in terms of dividend sustainability.

Wolverine Worldwide has a proven track record.

Even with a long history of dividends, the company’s dividends have been extremely stable. Since 2014, dividends have totaled $0.24 to $0.40 per year. This works out to be a compound annual growth rate (CAGR) of approximately 5.2% over that period. We believe this is an attractive combination as dividends have grown at a reasonable rate over this period and payments are not significantly reduced over time, which is a significant positive for shareholder returns. I am.

Limited growth potential through dividends

Investors who have held the company’s stock over the past few years will be happy with the dividend income they have received. Unfortunately, things aren’t as good as they seem. Wolverine Worldwide’s EPS has decreased by approximately 52% per year over the past five years. A significant decline in earnings per share doesn’t bode well from a dividend perspective. Even conservative dividend payout ratios can come under pressure if profits decline significantly. But things are actually looking up next year, with revenues set to increase. Wait until it becomes a pattern before you get too excited.

In summary

Overall, it’s great to see stable dividend payments, but we think the current payout levels may become unsustainable in the long term. Although the company brings in a lot of cash to cover its dividend, we don’t think that necessarily makes it a good dividend stock. You’ll probably look elsewhere for more profitable investments.

Investors generally prefer companies with consistent and stable dividend policies over companies with irregular dividend policies. At the same time, there are other factors that readers should be aware of before pouring capital into stocks. As just one example, we found that 2 warning signs for Wolverine Worldwide You should know, one of them is a little worrying.Looking for more high-yield dividend ideas? Try ours A group of people with strong dividends.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link