[ad_1]

The U.S. economy is striking a delicate balance between significantly reducing inflation and avoiding a recession. Although policymakers have succeeded in steering the economy toward a “soft landing,” challenges remain in efforts to further reduce inflation without triggering a recession.

Despite the positive outlook among economists, potential pitfalls include expected rate cuts by the Federal Reserve, upcoming elections in major economies, and the balance between stimulating consumption and avoiding a resurgence in inflation. It will be done.

Despite recent positive economic signs, uncertainties remain, and experts emphasize the need for prudent policy measures to sustain growth. Amid the uncertainty, these three stocks don’t look promising.

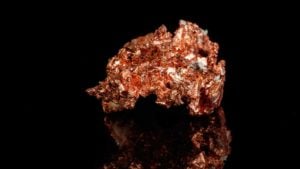

Southern Copper Corporation (SCCO)

Source: Coldmoon Photoproject/Shutterstock.com

Southern Copper Corporation (New York Stock Exchange:SCCO) is a mining company engaged in the exploration, smelting and refining of copper, among other minerals, in South America. Six WSJ analysts have rated SCCO a Sell, with a median 12-month price target of $64.00 and a range of $93.00 to $47.00.

The global mining industry is expected to grow at a CAGR of 5.1% from now until 2030. Government support for digital mining innovation and improved mining technology has strengthened the market.

SCCO reported third-quarter revenue of $2.51 billion, an increase of 16.17% year-over-year. The company’s EPS also increased by 19.40% to $0.80. SCCO stands out among its competitors with his leveraged FCF margin of 27.39%. However, zinc production and zinc and copper sales also fell by more than 10% in the third quarter. The company’s total operating costs and expenses increased $67 million, or 5%, compared to 2022. Silver production also decreased by 10%, and refined silver production decreased by 11.4%.

Expeditors International of Washington, Inc. (EXPD)

Source: Travel Mania / Shutterstock

Expeditors International of Washington Incorporated (New York Stock Exchange:expansion) is a global logistics company specializing in various transportation logistics services. Seven WSJ analysts have rated the stock a Sell, with a median 12-month price target of $105.00, a high of $128.00, and a forecast of $84.00.

The global logistics market is expected to grow at a CAGR of 10.7% and reach $18.23 trillion by 2030. The increasing digitalization of transportation processes and the expansion of the e-commerce industry into the logistics market are all major growth factors for this market.

In the third quarter, Expeditors International reported 2.19 billion visitors, a decrease of 49.80% year-over-year. EPS decreased by 54.33% and FCF decreased by 71.25%. His EXPD’s financial performance in the third quarter was struggling, and as demand continues to slow and interest rates continue to soften, the company could see further financial deterioration in the coming quarters.

Inflationary pressures are driving up the prices of consumer goods and are one of the many factors causing the mismatch between supply and demand in the shipping industry. This has brought shipping costs below what they were during the pandemic. EXPD has also reduced its workforce by 8% from the end of 2022, indicating a deterioration in its financial performance.

CH Robinson Worldwide (CHRW)

Source: Vitpho/Shutterstock.com

CH Robinson Worldwide, Inc. (NASDAQ:CHRW) is a transportation company whose main business is freight transportation, as well as management, brokerage, and warehousing.

Most analysts rate CHRW as a Hold or Underperform the market, indicating weak stock performance. Furthermore, we are targeting a median price of $87.50 below the current price. This median price target indicates that most analysts are pessimistic about the stock’s ability to generate more profits.

CHRW competes in the freight and logistics market, which is expected to have a CAGR of 5.87% from 2022 to 2028. The main driving force driving the growth of the industry is the increase in infrastructure construction. Another variable to consider in view of market growth is third-party logistics, which allows convenient and wide range of services to facilitate business expansion.

CHRW’s sales increased from $23,102 million in 2021 to $24,697 million in 2022, with a sales growth rate of 6.90%. However, this pales in comparison to last year’s growth rate of 42.54%, indicating a slowdown in earnings. Other metrics show that the company’s overall growth has similarly slowed. For example, net income increased by only 11.40% in 2022 compared to 66.71% in 2021.

The freight downturn throughout this year has impacted CHRW’s ability to generate profits. The recession continues to disrupt the company’s stock price, which is expected to continue into 2024. If the economic downturn continues, it will be difficult for CHRW to find effective ways to generate revenue.

Slowing financial growth and a freight downturn are enough reasons for investors to sell CH Robinson stock.

On the date of publication, Michael Que did not have (directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer and are influenced by InvestorPlace.com. Publishing guidelines.

The researchers contributing to this article do not hold (directly or indirectly) any positions in the securities mentioned in this article..

[ad_2]

Source link