[ad_1]

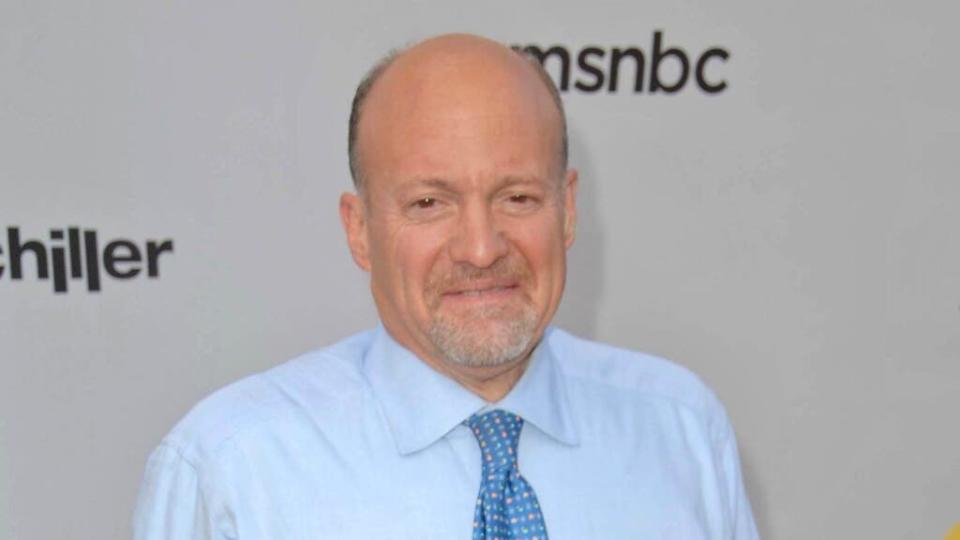

Jim Cramer, known for his work on CNBC’s “Mad Money,” is one of the most popular financial news anchors with a net worth of approximately $150 million. He is the founder and former portfolio manager of the hedge fund Kramer Berkowitz, which has returned nearly 24% after management and incidental fees.

Cramer is also the co-host of “Squawk on the Street” and “CNBC Investing Club with Jim Cramer,” which air daily at 9 a.m. ET on CNBC.

The Harvard graduate has a bullish outlook for 2024 after the Federal Reserve achieved a soft landing.

“Assuming the economy stays on its current moderate trajectory, the Fed is not only no longer our enemy, it’s far more likely to become our ally,” Cramer said. “This is the reversal the bulls have been waiting for.”

Do not miss it:

He recommends two stocks to watch in 2024.

JP Morgan Chase

JPMorgan Chase & Co. (NYSE:JPM) is the largest bank in the United States, with approximately $3.9 trillion in assets as of September 30th. JPMorgan was one of the best-performing banking stocks, despite the banking woes triggered by the Silicon Valley Bank collapse in March. , will rapidly increase by nearly 27% in fiscal 2023.

The stock rose 1.16% on the first trading day of 2024, closing at an all-time high of $172.08. Barclays issued an Overweight rating on JPMorgan stock on January 2nd, with a price target of $212, reflecting an upside potential of over 23%.

JPMorgan benefited greatly from its acquisition of bankrupt First Republic Bank in May by successfully retaining 90% of its customers since the acquisition.

JPMorgan also reported better-than-expected financials for the third quarter of fiscal 2023, which ended in September, with the bank’s net interest income up 30% year over year to $22.9 billion. Excluding First Republic Bank customers, JPMorgan’s net interest income increased 21% in the third quarter from a year ago.

This momentum is likely to continue in the short term, with analysts expecting the giant to post annual earnings per share (EPS) of $15.16 in 2023, up 25.5% year over year.

general motors

general motors company (NYSE:GM), one of the top four U.S. automakers, is poised for a turnaround in 2024 after making significant structural changes to streamline its operations. The stock is off to a strong start to 2024, gaining 36 basis points on the first trading day of the year.

Citigroup rates General Motors stock a “buy” with a price target of $95, indicating an upside potential of more than 163%. RBC Capital Markets maintains an outperform rating on the stock with a price target of $54, indicating near 50% upside potential.

The company is focused on establishing its dominance in the electric vehicle (EV) space and aims to manufacture at least 1 million EVs in North America by next year. General Motors has also taken steps to boost shareholder returns to revive investor interest, raising its annual dividend by 33% to $0.48 starting this month.

“We have finalized a budget for 2024 that fully offsets the incremental costs of the new collective agreement, and the long-term plans we are implementing include reducing the capital intensity of our business, developing product General Motors Chairman and CEO Mary Barra said in November that “this clear path forward and the strength of our company” With a strong balance sheet, we will return significant capital to our shareholders.”

Read next:

“The Active Investor’s Secret Weapon” Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

The article Jim Cramer’s Economic Outlook: Recession Predictions Turn Out to be Wrong, Here’s Where to Invest appeared first on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[ad_2]

Source link