According to multiple experts, securing and building an emergency fund is fundamental to financial health.

An emergency fund is usually equivalent to three to six months of living expenses. Having such assets may prevent you from taking on debt or dipping into your retirement savings, for example.

However, according to a study by LendingTree, 27% of Americans say they are in debt because they couldn’t cover emergency expenses. And of those who faced a financial emergency in the past six months, more than half (55%) went into debt because of it. The survey found that 27% of respondents had debts of $5,000 or more. Additionally, the Federal Reserve’s report on the economic well-being of U.S. households found that a whopping 37% of Americans don’t have $400 to cover an emergency.

Employers begin offering emergency funding plans

Because of this, many employers are taking notice and offering emergency funding plans as part of their benefits package.

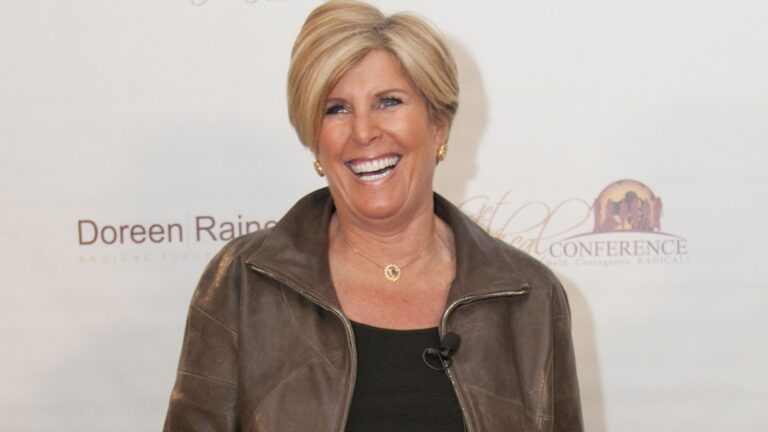

For example, several companies use programs such as Fidelity’s Goal Booster, which is used by Starbucks, Delta, and Whole Foods, and Suze Orman’s SecureSave.

So far, Fidelity has contracts with 10 large payroll employers. Emily Colle, Fidelity’s vice president of Goal Booster Programs, said that thousands of employers offer Goal Boosters to their employees, who can earn money through their bank or credit union accounts rather than through their paychecks. It is said that it is providing funding.

Mr. Kore pointed out the importance of having an emergency fund. But she emphasized the fact that many Americans are struggling to maintain this type of savings, due in part to inflation, market volatility and the pandemic.

“A recent Fidelity survey found that lack of emergency savings is a major source of stress for Americans, with 8 out of 10 Fidelity participants saying inflation and the cost of living cause stress. “And half said inflation and the cost of living cause them stress,” Kole said, “to distract them while they work.”

It added that employers are in a unique position to help address the short-term savings needs of their employees. Doing so may also allow employees to save more effectively for long-term goals such as retirement.

“Additionally, through Fidelity’s Goal Booster, employees can not only set and manage savings goals, but also allow employers to integrate payroll and allow employees to deposit money directly from their paychecks into goal-based accounts. There are options,” she said. Added.

Emergency savings mean a better, more secure retirement

Colle says saving for emergencies has significant financial benefits. Employees who have access to short-term savings when they need it are more likely to be financially confident, have higher financial health scores, and be “on track” for retirement.

“Employees who are financially well-off are 10 times more likely to be engaged at work than those who are less well-off,” she says.

Why are these plans beneficial to employees?

Some experts said savings are more likely to occur in these types of accounts (accounts where a third party is involved), especially if the employer offers incentives such as matching funds. .

“Honestly, anyone can go to their bank and have $20 automatically transferred to a different account every week. There’s nothing new there,” says CFP and founder of Financial Wellness Strategies. said Bobby Revell, “The truth is, most of us aren’t. We’re busy, so we’re going to tackle it as soon as we have time.”

Employer involvement, she says, puts it on the “now” agenda.

Another great thing, Rebell says, is that there’s a third party involved, which makes accessing your savings a little more difficult.

“If you save money in a separate account, you can simply use it for day-to-day expenses as needed.However, if the funds are not kept in a personal account, they cannot be accessed by a third party. need to take additional steps,” she said.

Revell also noted that, unfortunately, people turn to other avenues when they don’t have cash on hand for emergencies.

“Elsewhere, whether you put it into your retirement savings and pay a penalty or put it on a credit card and pay interest, it’s almost always going to be affected,” she says.

She says these emergency savings plans through the workplace are becoming more popular as people realize the importance of financial health.

“Companies like Financial Wellness Strategies are emerging to help businesses support the financial well-being of their employees, reduce financial anxiety, and increase presence and productivity at work.” she added.

GOBankingRates Details

[ad_2]

Source link